Billions spent. Now what? - 25/03/2024

How AI investments are shaping the future of technology

Billions spent. Now what?

“Cash rules everything around me. C.R.E.A.M. get the money— dollar dollar bill, yo.”

—Wu-Tang Clan

Goldman Sachs forecasts that investments in AI will approach $200 Billion globally by 2025. Sam Altman, the founder of OpenAI, seeks trillions of dollars to reshape business of chips and AI. Nvidia, with their shovel selling business has had a largest single day gain in market cap - $247 billion added - and shot past Google to become third most valuable US company. VC, but also PE, money doesn’t flow much at the moment - but when it does it goes to AI companies.

Billions of dollars have already been invested and much more will be invested in one of the greatest bull runs the world has ever seen.

The key word here is invested. All of the money that was and will be spent, was spent in an expectation of a positive return in the form of income or price appreciation - with statistical significance.

This is the core premise of investing. 1$ in a year is less valuable than 1$ today, so we forgo today’s consumption in order to be able to consume more in the future. And, we want to be fairly certain that our investment will pay off.

You see where I’m going with this?

Platforms

There is an incentive for big cloud providers to spend as much money on models and AI capabilities in their data centres as a strategy for reducing their taxes.

Companies like Google, Amazon (AWS), and Microsoft (Azure), with substantial cash reserves, have been seeking growth opportunities but have faced challenges due to a lack of suitable acquisition targets and antitrust regulations. Therefore, they are investing in the next generation of cloud infrastructure, utilising their cash without taking a P&L hit.

The rapid build-out of cloud data centres by major tech companies is largely due to favourable accounting and M&A conditions. When these companies purchase chips from Nvidia, they can classify the expenditure as a capital expenditure rather than an operating expense. This allows them to avoid immediate impact on their profit and loss (P&L) statement and instead depreciate the cost over time.

They are also required to innovate in order to maintain their market share. If one of these major players were to slow down or halt their investments, it could create an opportunity for competitors to gain market share. This is because potential customers may perceive the slower-investing company as falling behind in terms of technology, capabilities, or reliability.

Platforms and providers - like Nvidia, OpenAI, Microsoft’s Azure, AWS, and others have been wildly successful.

GPTs, Soras, Midjourneys, H100s, Elevenlabs’, DALL-Es of the world are keeping us in constant state of amazement. Sagemakers, Vertexes (Vertices?), and Azure GPT deployments are being sold to anyone that wants to buy, and it’s not uncommon to get 30%-40% discounts on the payment plans. All in the name of gaining and maintaining market share as these companies build out their infrastructure.

https://www.youtube.com/watch?v=ag14Ao_xO4c

However, there’s a big chunk of the AI investments are relying on the promise of productivity improvements that AI will bring. Productivity improvement is great - a man with rakes can do only a fraction of what a man with combine harvester can do. And a man with magical alien technology? The sky is the limit. Productivity improvement is a core notion of technology.

Did those things happen yet?

We won’t cover much of the socioeconomic impacts the AI will have on our civilisation, this will be discussed at another time. But what we can say now is that it looks like this promised improvements in productivity will work in everyone’s favour, especially given the fact that the population in advanced economies is shrinking fast across the board. This burdens pensions and if you’re reading this, chances are that the economy you live in is affected by this. Any performance increase would be a welcome gift.

Applications, applications, applications

The rate of progress in AI is mind-blowing, not akin to anything we’ve seen in the history of the world. The applications however - or business use cases - are lacking.

This is not to say that there aren’t any. A lot of industries, including healthcare, pharma, finance, content creation (including creative industries), are poised to be turned on their head.

It’s a weird world we’re living in. Google being evil. Apple being a cheapskate. Meta doing the best for the community. The only constant - Micro$oft

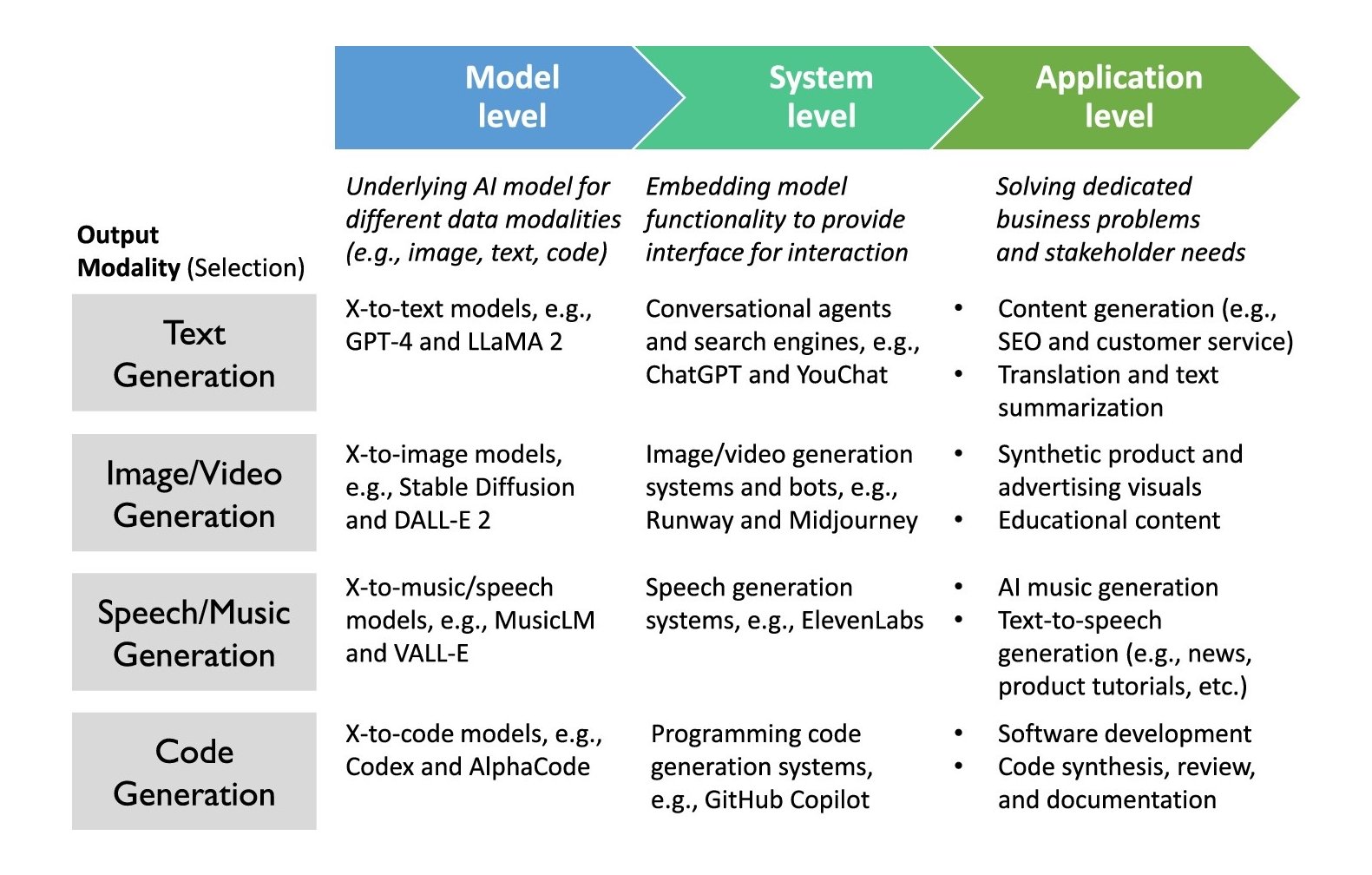

But, most of the money - if it’s not used by the Platforms - is flowing to Generative AI. There’s no doubt that, as we adopt these new technologies new applications and markets will be created, but at this point, it seems that most of the real use cases can be like this:

The big questions about Generative AI - its real value now and in the future, how good an investment it is, and how long this excitement will last are critical. Everyone’s talking about how AI can change the game, but it’s tricky to see what’s real and what’s just hype.

- Real Value: Right now, AI’s making some tasks easier and opening new doors, especially in creative fields. But turning these cool tools into real money is still a bit of a puzzle. As for the future, AI could be huge, but guessing how big it’ll get is tough. It depends on whether businesses really grab onto AI and how fast that happens.

- Market Potential: The potential market for Generative AI is big, but it’s also a bit of a guess. Some think AI will be everywhere, changing everything about how we work and live. Others say we’re moving too fast and need to slow down and think it through.

- Risk and Return: Investing in AI could pay off big, but it’s not a sure thing. The risks are real—things like new rules or people worrying about AI’s impact. If we’re not careful, these risks could turn the dream of big returns into a bubble that pops.

- Sustainability: The biggest question is whether this AI rush is something that can keep going strong or if it’ll fizzle out like other tech crazes in the past. We’ve seen it before with the dotcom and more recently crypto bubbles - lots of excitement, lots of money, then a big crash.

As we think about all this, it’s like looking back at the dotcom days. We’re excited about what AI can do, but we have to be smart. We need to figure out where AI can really help and make money, not just get caught up in the excitement. By staying grounded and focusing on real value, we can make the most of AI without repeating past mistakes.

No one knows the right answers to these questions, least of which myself. Keeping that in mind, let’s have a look what the Corporate Finance Institute has to say about the dotcom bubble and a subsequent crash.

[CFI Team. “Dotcom Bubble.” Corporate Finance Institute, corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/dotcom-bubble/. Accessed 29 Feb. 2024.](https://www.notion.so/CFI-Team-Dotcom-Bubble-Corporate-Finance-Institute-corporatefinanceinstitute-com-resources-care-72c4b0b123c74b469b6f68540f197385?pvs=21)

Causes of the Dotcom Crash

The cause of the dotcom bubble can be attributed to the following factors:

1. Overvaluation of dotcom companies

Most tech and internet companies that held IPOs during the dotcom era were highly overvalued due to increasing demand and a lack of solid valuation models. High multipliers were used on tech company valuations, resulting in unrealistic values that were too optimistic.

Analysts did not focus on the fundamental analysis of these businesses, and revenue generation capability was overlooked, as the focus was on website traffic metrics without value addition. Research carried out revealed an overvaluation of more than 40% of dotcom companies by studying their P/E ratios.

2. Abundance of venture capital

Money pouring into tech and internet company start-ups by venture capitalists and other investors was one of the major causes of the dotcom bubble. In addition, cheap funds obtainable through very low interest rates made capital easily accessible. It coupled with fewer barriers to acquiring funding for internet companies led to massive investment in the sector, which expanded the bubble even further.

3. Media frenzy

Media companies encouraged people to invest in risky tech stocks by peddling overly optimistic expectations on future returns and the “get big fast” mantra. Business publications – such as The Wall Street Journal, Forbes, Bloomberg, and many investment analysis publications – spurred demand through their media outlets adding fuel to a burning fire and further inflating the bubble. Alan Greenspan’s speech on “irrational exuberance” in December 1996 also set off the momentum on technological growth and buoyancy.

How to Avoid Another Bubble

The measures below provide some insights on how to avoid another internet bubble:

1. Proper due diligence

Investment in new start-ups and similar tech companies should only be considered after carrying out proper due diligence, which involves a closer look at the company’s fundamental drivers of value, such as cash flow generation and sound business models. The long-term potential of a stock should be properly analyzed, as a short-term focus will lead to the formation of another bubble.

2. Removing “investment of expectation”

Investors should desist from investments based on unrealized potential in entities that are yet to prove their cash flow generating ability and overall long-term sustainability. The expectations lead to the emergence of a bubble through speculation.

3. Avoiding companies with a high beta coefficient

During the dot-com bubble, most tech stocks posted high beta (greater than 1), meaning their downfall in times of recession would be much more than what the average market fall would be.

A high beta coefficient signals a high-risk stock in times of a market downturn. Since the opposite is true when there is a market boom, investors should be wary of a bubble formation.

But… This Time Is Different. Right?

In the book This Time Is Different - Eight Centuries of Financial Folly published in 2009, just after another crash the authors outlined how the central bankers, policy makers and investors involved in every financial bubble are utterly convinced that, in terms of economic events, “this time is different.” It shows how little do we learn from history, because tectonic shifts happen in regular intervals.

This Time Is Different: Eight Centuries of Financial Folly

Authors say “When you hear This time is different don’t walk, run” as a good rule to stop yourself from falling into the trap of mass mania that people tend to suffer from throughout history. However, as we stand on the brink of a new era, the phrase “this time is different” resonates, especially in the realm of artificial intelligence (AI).

Have a look at NASDAQ Composite Index [IXIC] before the Dotcom bubble and now. In 2023, the greatest Notice any similarities?

.png)

.png)

The Nvidia Case

At the moment, Nvidia is perceived as a bottom-of-the-pyramide of AI.

There are concerns about whether Nvidia’s growth is sustainable and if the current build-out may lead to an oversupply of infrastructure before the application layer can fully monetise it. The comparison between Nvidia and Cisco has become prevalent. However, there are key differences between the two companies.

During the early days of the internet, Cisco was considered the “picks and shovels” company of the internet, expected to greatly benefit from the infrastructure build-out. This included servers, fibre optic cables, and the telecommunication infrastructure that reshaped the world. Without Cisco then, we wouldn’t have social media, YouTube, Zoom (remember Skype?), the proliferation of smartphones, etc. Similarly, Nvidia is currently in a phase where it is providing crucial components for the build-out of cloud infrastructure.

Cisco’s valuation during the dot-com era was significantly higher and more inflated than Nvidia’s current valuation, which is based on real revenue, margins, and profit. The competition in the chip market may be more challenging than what Cisco faced due to the complex development cycles and requirements for specialised fabrication plants (fabs) to build chips. Additionally, GPUs are more difficult to copy and commoditise than Cisco’s servers and networking equipment, providing Nvidia with a stronger competitive moat. The complexity of Nvidia’s products, such as the H100 with its 35,000 components and 70-pound weight, further illustrates the difficulty in replicating their offerings.

Technical analysis looks at market trends as an actionable indicator of value. I don’t like technical analysis - in short I believe it’s a misinterpretation of the business’ underlying value.

https://youtube.com/clip/UgkxGLGYvJ7SXuaEBWJBXmQ1DHo7pTGdbpzA?si=gPdDH8SLJReqRYdS

The market will correct itself at some point, but it can take years before they do.

Markets have a mind of their own - and they often act not only on the value of the business but much more different factors. Markets not only allocate resources and distribute income, they also shape our culture, foster or thwart desirable forms of human development, and support a well defined structure of power. They are as much political and cultural institutions as they are economic.

I don’t have aptitude for the in-depth valuation of Nvidia along with others in Magnificent Seven (Apple, Amazon, Alphabet, Meta, Microsoft, and Tesla). Luckily, The Dean of Valuation, Aswath Damodaran, did it for me.

The Seven Samurai: How Big Tech Rescued the Market in 2023!

So, you’re saying that this is all hype?

No.

I have a personal experience with hype - I was working in Blockchain industry from 2016 to 2021. AI industry in 2024 is most important industry in the world, in the most important time in history. This is something that I never claimed about blockchain or crypto, nor have I gotten rich from selling sh*tcoins when I could have.

What I’m saying is, there is a noticeable discrepancy between the amounts of money and real-world applications that are delivering tangible business value. As we continue to develop AI, it is crucial that we focus on creating practical, useful applications that can truly transform industries and improve productivity. This requires us to separate genuine business use cases from the mass hype that surrounds AI. While it is easy to get caught up in the excitement and potential of AI, we must remain grounded and focus on developing applications that can deliver real value to businesses and society as a whole.

We’re on the edge of a big shift with artificial intelligence (AI), where lots of money and big names are jumping in, hoping to hit gold. Everyone’s buzzing about how AI is going to change our work and life. But in this rush, there’s a gap: while the money flows in, the real-world uses of AI aren’t keeping up. It’s like we’ve got the tools but we’re not quite sure what to build with them yet.

Excitement’s great, but without real results, it can lead us astray. Take Nvidia, for example. They’re a key player in making AI happen, showing us that smart moves today are based on real work, not just dreams. But even with their success, we’ve got to stay sharp and not get carried away by overvaluing things.

So, it’s crucial to keep our heads cool. We’ve got to dig deeper and find those real-world applications that can truly benefit from AI. This means separating the solid business cases from the hype. Yes, AI’s got huge potential to improve how we live and work. But to truly unlock this potential, we need to focus on creating practical solutions that solve real problems, not just jump on the bandwagon.

Goldman Sachs. “AI Investment Forecast to Approach $200 Billion Globally by 2025.” Goldman Sachs, 1 Aug. 2023, www.goldmansachs.com/intelligence/pages/ai-investment-forecast-to-approach-200-billion-globally-by-2025.html.

Asa Fitch, Keach Hagey. “Sam Altman Seeks Trillions of Dollars to Reshape Business of Chips and AI.” WSJ, 8 Feb. 2024, www.wsj.com/tech/ai/sam-altman-seeks-trillions-of-dollars-to-reshape-business-of-chips-and-ai-89ab3db0.

Morris, Chris. “Nvidia Shoots Past Alphabet to Become the Third Most Valuable U.S. Company.” Fortune, 15 Feb. 2024, fortune.com/2024/02/15/nvidia-third-most-valuable-u-s-company-alphabet-microsoft-apple/. Accessed 29 Feb. 2024.

Amdur, Eli. “Venture Capital in AI – Where and How Much.” Forbes, 16 Nov. 2023, www.forbes.com/sites/eliamdur/2023/11/16/venture-capital-in-ai—where-and-how-much/?sh=2b33cecb20e0. Accessed 29 Feb. 2024.

Feuerriegel, S., Hartmann, J., Janiesch, C. et al. Generative AI. Bus Inf Syst Eng 66, 111–126 (2024). https://doi.org/10.1007/s12599-023-00834-7

Bowels, Samuel. “What Markets Can—and Cannot—Do.” Challenge, vol. 34, no. 4, 1991, pp. 11–16. JSTOR, http://www.jstor.org/stable/40721264. Accessed 29 Feb. 2024.

Adinolfi, Joseph. “Wall Street Keeps Comparing Nvidia to Dot-Com-Era Cisco. Is It Justified?” MarketWatch, 21 Feb. 2024, www.marketwatch.com/story/wall-street-keeps-likening-nvidia-to-dot-com-era-cisco-is-the-comparison-justified-eed307c1. Accessed 1 Mar. 2024.

CFI Team. “Dotcom Bubble.” Corporate Finance Institute, corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/dotcom-bubble/. Accessed 29 Feb. 2024.